I asked: What's the goal?

Mrs. B: I want a fixed rate.

Me: What's the rate you're paying now?

Mrs. B: 4.00% but it will adjust in 2015

Me: Is it a fully amortized loan i.e. are you paying principal and interest?

Mrs. B: Yes

Me: Is the current payment affordable?

Mrs. B: Yes

Me: Contrary to popular belief you'll be better served with your current mortgage.

Mrs. B: ????????

Me: You have roughly a 70% equity position, you're paying down principal each month, it's a very affordable monthly payment, you don't need or want any cash... correct?

Mrs. B: Yes

Me: The Fed has repeatedly stated that they will maintain the current target rate of 0%-.25% well into 2015. While the Fed doesn't control mortgage rates their policy does influence trends for all other indexes long and short term. This means when your rate adjusts it will adjust LOWER.

Mrs. Babikian's mortgage is a 5/1 Libor ARM. Per the terms of her note the rate is fixed at 4.000% for the first 5 years and subject to change on April 1, 2015.

Section 4(D) of her note reads -

The interest rate I am required to pay at the first Change Date will not be greater than 9.000% or less than 2.25%. Thereafter, my interest rate will never be increased or decreased on any single Change Date by more than TWO (2.00%) from the rate of interest I have been paying for the preceding 12 months. My interest rate will never be greater than 9.000%.

Currently the 12 month LIBOR is .639% plus 2.25% margin and you get a fully indexed rate of 2.889%. Pretty nice, huh?

In light of what our Fed Chairman has been saying for the last 4 years and just said again two days ago, there's simply no reason to expect significant increases until at least 2018.

Of course, many would argue that I'm giving bad advice rebutting with statements like "Rates are artificially low right now." and "It's not sustainable!"

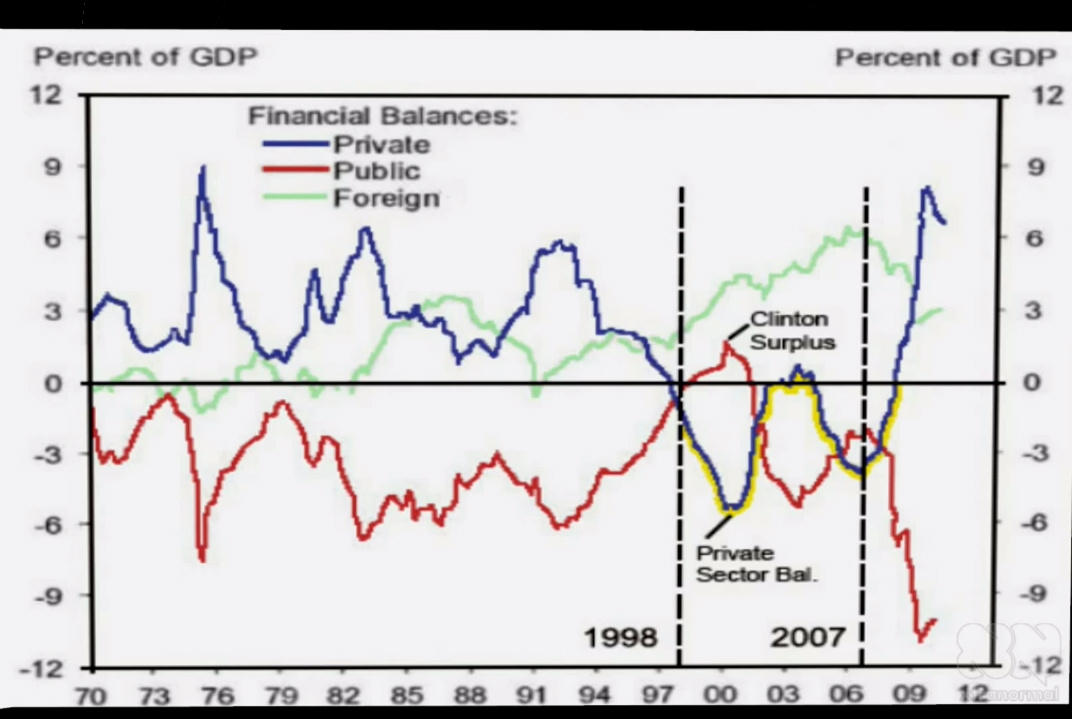

Like my Grammy used to say "Ahwww, you're pullin' my leg!" Fact is, for a sovereign currency issuer it is totally sustainable. Here's another fact - The natural rate of interest is zero.